Embark on a comprehensive exploration of Medicare Com 2024, where we unravel the intricacies of coverage updates, new benefits, and essential resources. Join us as we delve into the world of Medicare, deciphering the latest modifications to empower you with informed decision-making.

Medicare Com 2024 presents a transformative landscape of healthcare coverage, offering a multitude of changes that directly impact beneficiaries. From adjustments to premiums and deductibles to the introduction of innovative benefits, this guide provides an in-depth analysis of the evolving Medicare landscape.

Medicare Coverage Changes in 2024

Medicare, the federal health insurance program for individuals aged 65 and older, will undergo several changes in coverage for 2024. These modifications aim to enhance the program’s effectiveness, ensure its sustainability, and improve access to healthcare services for beneficiaries.

The primary alterations to Medicare coverage in 2024 involve adjustments to Part A and Part B premiums, deductibles, and copayments. Additionally, there will be modifications to the coverage of certain healthcare services and prescription drugs.

Part A Coverage Changes

Medicare Part A, which covers hospital insurance, will see an increase in the deductible for 2024. The deductible, which represents the amount beneficiaries must pay before Medicare begins to cover expenses, will rise to $1,660 per benefit period. This represents an increase of $44 from the 2023 deductible of $1,620.

Additionally, the daily coinsurance for hospital stays will also increase slightly in 2024. For the first 60 days of hospitalization, the coinsurance will increase from $208 per day to $210 per day. For days 61-90, the coinsurance will rise from $416 per day to $420 per day.

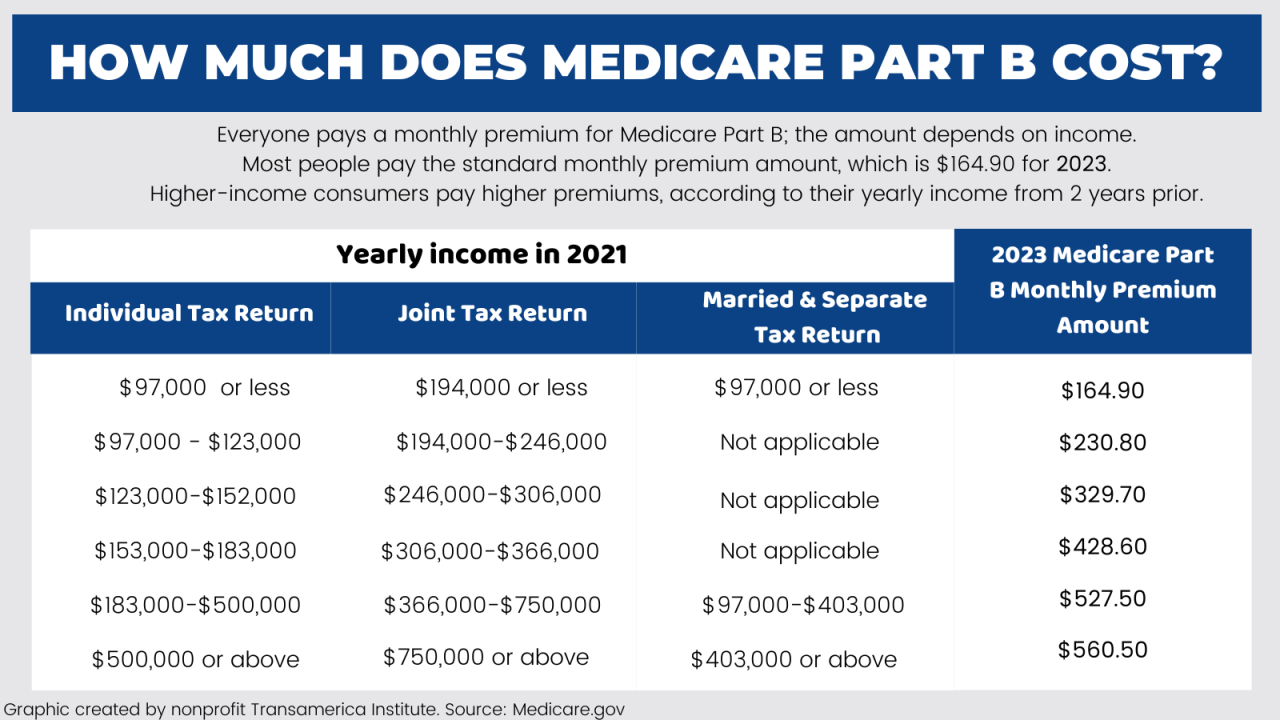

Part B Coverage Changes

Medicare Part B, which covers medical insurance, will also undergo some coverage changes in 2024. The Part B premium, which is deducted from beneficiaries’ Social Security benefits, will increase to $170.10 per month in 2024. This represents an increase of $5.20 from the 2023 premium of $164.90.

The Part B deductible, which represents the amount beneficiaries must pay before Medicare begins to cover expenses, will also increase in 2024. The deductible will rise to $233, an increase of $7 from the 2023 deductible of $226.

Impact of Coverage Changes

The changes to Medicare coverage in 2024 will have varying impacts on beneficiaries. Some beneficiaries may experience higher out-of-pocket costs due to the increased deductibles and coinsurance. However, these changes are necessary to ensure the long-term sustainability of the Medicare program and to continue providing essential healthcare services to beneficiaries.

New Medicare Benefits for 2024

Medicare beneficiaries can expect to see several new benefits and expanded coverage options in 2024. These changes are designed to improve access to essential healthcare services, reduce out-of-pocket costs, and enhance the overall quality of care.

Free Yearly Wellness Visits

Beginning in 2024, Medicare will cover one free yearly wellness visit for all beneficiaries. This visit will include a comprehensive health screening, personalized health plan, and counseling on preventive care measures. The goal of these visits is to promote early detection of health issues and encourage proactive health management.

Expanded Coverage for Telehealth Services

Medicare will expand coverage for telehealth services, making it easier for beneficiaries to access healthcare remotely. This will include coverage for virtual visits with healthcare providers, mental health counseling, and chronic disease management. Telehealth services provide increased convenience, reduced travel expenses, and improved access to care, especially for beneficiaries in rural or underserved areas.

Coverage for Behavioral Health Services

Medicare will introduce coverage for a range of behavioral health services, including mental health counseling, substance use disorder treatment, and cognitive behavioral therapy. These services will be available to all beneficiaries, regardless of age or income. The inclusion of behavioral health coverage acknowledges the importance of mental well-being and aims to address the growing need for mental health support.

Enhanced Chronic Disease Management

Medicare will enhance its coverage for chronic disease management, providing more support to beneficiaries with conditions such as diabetes, heart disease, and cancer. This will include access to personalized care plans, disease management programs, and support groups. These enhancements aim to improve outcomes, reduce complications, and empower beneficiaries to better manage their chronic conditions.

Medicare Advantage Plan Updates for 2024

Medicare Advantage plans are becoming increasingly popular among Medicare beneficiaries, and for good reason. These plans offer a variety of benefits, including comprehensive coverage, lower out-of-pocket costs, and the convenience of one-stop shopping. In 2024, Medicare Advantage plans will undergo some significant changes that beneficiaries should be aware of.

Plan Options

One of the most significant changes to Medicare Advantage plans in 2024 is the expansion of plan options. Beneficiaries will now have more choices when it comes to selecting a plan that meets their needs and budget. New plan options will include:* Medicare Advantage Value-Based Insurance Design (VBID) plans: These plans are designed to reward beneficiaries for taking steps to improve their health.

Beneficiaries who participate in wellness programs or meet certain health goals may earn rewards, such as lower premiums or reduced out-of-pocket costs.

Medicare Advantage Special Needs Plans (SNPs)

These plans are designed for beneficiaries with specific health conditions, such as chronic illnesses or disabilities. SNPs offer tailored benefits and services that are designed to meet the unique needs of these beneficiaries.

Premiums and Benefits

In addition to the expansion of plan options, Medicare Advantage plans will also see some changes to premiums and benefits in 2024.* Premiums: The average Medicare Advantage premium is expected to increase by about 3% in 2024. However, there will be some variation in premiums depending on the plan and the region in which the beneficiary lives.

Benefits

Medicare Advantage plans will continue to offer a wide range of benefits in 2024, including:

Medical coverage

Prescription drug coverage

Dental coverage

Vision coverage

Hearing coverage

Implications for Beneficiaries

The changes to Medicare Advantage plans in 2024 will have a number of implications for beneficiaries. Beneficiaries should carefully consider their options and choose a plan that meets their needs and budget. Beneficiaries who are already enrolled in a Medicare Advantage plan should review their plan’s benefits and premiums to make sure that it still meets their needs.

Medicare Prescription Drug Coverage in 2024: Medicare Com 2024

Medicare Part D, the prescription drug coverage component of Medicare, will undergo several changes in 2024. These modifications aim to enhance the program’s effectiveness and accessibility while addressing the evolving needs of beneficiaries.

One significant adjustment is the introduction of a new formulary system. The formulary is a list of covered medications that beneficiaries can access through Part D plans. In 2024, the formulary will be updated to include a broader range of generic and brand-name drugs, providing beneficiaries with more options to choose from.

Copayment and Coverage Policies

Copayments, the fixed amount beneficiaries pay for their prescriptions, will also see some adjustments in 2024. While copayments may vary depending on the specific Part D plan, overall, beneficiaries can expect to see a slight increase in copayments for certain medications.

This adjustment aims to balance the cost of providing prescription drug coverage while ensuring affordability for beneficiaries.

Coverage policies will also undergo some modifications in 2024. Part D plans will have more flexibility in determining which medications are covered and the specific coverage criteria for each drug. This flexibility is intended to allow plans to tailor their coverage to the specific needs of their beneficiaries while maintaining a balance between cost and access.

Impact on Beneficiaries

The changes to Medicare Part D prescription drug coverage in 2024 are expected to have a mixed impact on beneficiaries. While the expanded formulary and coverage flexibility may provide beneficiaries with more options and greater access to medications, the potential increase in copayments may pose financial challenges for some.

To mitigate the impact of these changes, beneficiaries are encouraged to carefully review their Part D plan options during the annual enrollment period. By comparing plans and understanding the specific coverage details, beneficiaries can make informed decisions that align with their individual needs and financial circumstances.

Medicare Supplement Insurance Updates for 2024

Medicare Supplement insurance plans, also known as Medigap policies, help cover out-of-pocket costs associated with Original Medicare (Part A and Part B). For 2024, there are some important updates to Medigap plans that beneficiaries should be aware of.

One significant change is the elimination of the Medigap Plan F high-deductible option. This plan previously offered lower premiums in exchange for a higher deductible, but it will no longer be available for new enrollees starting January 1, 2024.

Another change is the introduction of a new Medigap Plan G high-deductible option. This plan will have a lower premium than the standard Plan G but will also have a higher deductible. Beneficiaries who are willing to pay a higher deductible may consider this option to save on their monthly premiums.

In addition to these changes, there may be adjustments to premiums and benefits for other Medigap plans. Beneficiaries should contact their insurance provider or an insurance agent to learn about the specific changes that will affect their plan.

Impact on Beneficiaries

The elimination of the Medigap Plan F high-deductible option may affect beneficiaries who are considering this plan. They may need to consider other Medigap options, such as Plan G or Plan N, which have lower deductibles but higher premiums.

The introduction of the Medigap Plan G high-deductible option may be beneficial for beneficiaries who are willing to pay a higher deductible to save on their monthly premiums. This option can be particularly attractive for those who do not anticipate incurring significant medical expenses.

It is important for beneficiaries to review their Medigap coverage options carefully and consider their individual needs and financial situation when making a decision about which plan to choose.

Medicare Savings Programs for 2024

Medicare Savings Programs are designed to assist low-income Medicare beneficiaries with the costs of Medicare premiums, deductibles, and coinsurance. These programs include Qualified Medicare Beneficiary (QMB), Specified Low-Income Medicare Beneficiary (SLMB), and Qualified Individual (QI) programs.Eligibility for these programs is based on income and asset limits, which vary by state.

In general, individuals must have income below 135% of the federal poverty level and assets below $4,000 for individuals or $6,000 for couples.Medicare Savings Programs can provide significant financial assistance to eligible beneficiaries. For example, QMB covers all Medicare Part A and Part B premiums, deductibles, and coinsurance costs.

SLMB covers Medicare Part B premiums and coinsurance costs, but not deductibles. QI covers Medicare Part B premiums only.These programs can help low-income Medicare beneficiaries access the healthcare they need without facing financial hardship.

Medicare Resources and Support for 2024

In 2024, Medicare beneficiaries will have access to a range of resources and support services to help them understand and navigate their coverage options. The State Health Insurance Assistance Program (SHIP) is a federally funded program that provides free, unbiased counseling and assistance to Medicare beneficiaries.

SHIP counselors can help you understand your Medicare coverage, choose the right plan for your needs, and resolve any issues you may have with your coverage.

Contacting SHIP, Medicare com 2024

To contact your local SHIP, you can visit the SHIP website at www.shiphelp.org or call 1-800-677-1116. You can also find contact information for your local SHIP on the Medicare website at www.medicare.gov.

Closing Summary

As we conclude our journey through Medicare Com 2024, we leave you with a comprehensive understanding of the latest updates and their implications. Whether you’re a seasoned Medicare beneficiary or navigating the program for the first time, this guide has equipped you with the knowledge and resources to make informed choices about your healthcare coverage.

Remember, Medicare Com 2024 is not just a series of changes; it’s an opportunity to optimize your healthcare experience and secure the best possible coverage for your needs.

Expert Answers

What are the key changes to Medicare Part A and Part B coverage in 2024?

Medicare Part A and Part B coverage will undergo several modifications in 2024, including adjustments to premiums, deductibles, and copayments. These changes aim to ensure the sustainability of the Medicare program while continuing to provide essential healthcare services to beneficiaries.

Are there any new benefits being added to Medicare coverage in 2024?

Yes, Medicare Com 2024 introduces several new benefits, including coverage for certain over-the-counter medications, expanded access to telehealth services, and enhanced support for beneficiaries with chronic conditions.

How do the changes to Medicare Advantage plans affect beneficiaries?

Medicare Advantage plans will see modifications to plan options, premiums, and benefits in 2024. Beneficiaries should carefully review these changes to determine the plan that best meets their individual needs and preferences.