Introducing the Google Sheets Personal Finance Tracker 2024, your indispensable companion for effortless financial management. Harness the power of Google Sheets to take control of your finances, simplify budgeting, and achieve your financial goals.

With its intuitive interface, customizable features, and robust functionality, the Google Sheets Personal Finance Tracker empowers you to track expenses, create budgets, set financial targets, and analyze your financial performance like a pro.

Introduction

Personal finance management is essential for individuals to control their financial resources and achieve their financial goals. It involves planning, tracking, and managing income, expenses, and assets to ensure financial stability and long-term success.

Google Sheets is a powerful tool for personal finance tracking due to its versatility, accessibility, and user-friendly interface. It offers a wide range of features, including:

Benefits of Google Sheets

- Spreadsheet functionality for organizing and visualizing financial data

- Formula and function capabilities for automating calculations and analysis

- Collaboration options for sharing and working with others

- Cloud-based storage for easy access and security

Setting Up a Google Sheets Personal Finance Tracker

Creating a Google Sheets personal finance tracker is a straightforward process that can help you manage your finances effectively. Here’s a step-by-step guide to get you started:

Creating a New Google Sheet

- Log in to your Google account and go to Google Sheets .

- Click on the “Blank” template to create a new spreadsheet.

- Rename the sheet to “Personal Finance Tracker” or any other suitable name.

Setting Up Different Tabs

To organize your tracker, create different tabs or sections for each financial category. Here are some common categories:

- Income:Track all sources of income, such as salary, dividends, and investments.

- Expenses:Categorize and record your expenses, such as rent, groceries, and entertainment.

- Savings:Set up a tab to track your savings goals and progress towards them.

- Investments:If you invest, create a tab to monitor your portfolio’s performance.

Creating Formulas and Functions

To automate calculations and track your financial progress, use formulas and functions in Google Sheets:

SUM(range): Adds up values in a range of cells. AVERAGE(range): Calculates the average of values in a range. IF(condition, true_value, false_value): Evaluates a condition and returns a specified value based on the result.

For example, to calculate your total income, you can use the formula =SUM(B2:B10), where B2:B10 is the range of cells containing your income values.

Features and Functionality of the Tracker

The Google Sheets Personal Finance Tracker is equipped with a range of features that cater to various financial management needs. These include:

Expense Categorization

The tracker allows you to categorize your expenses into predefined or custom categories, such as groceries, entertainment, and transportation. This helps you identify areas where you spend the most and where you can potentially save.

Budgeting Tools

The tracker provides budgeting tools to help you plan and track your spending. You can set up monthly or annual budgets and monitor your progress against them. The tracker will alert you if you’re overspending in any category.

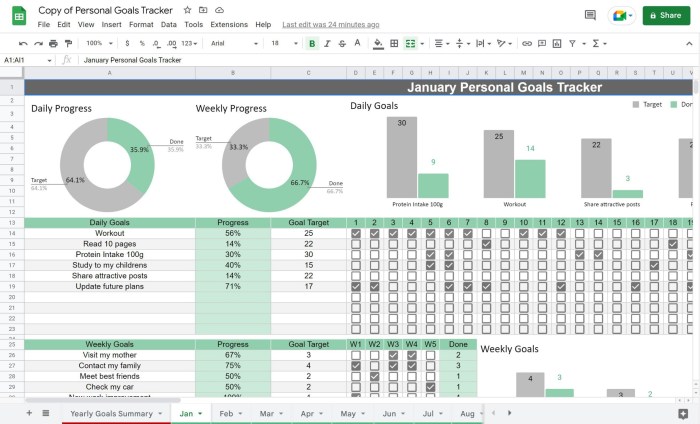

Goal Tracking

The tracker allows you to set financial goals, such as saving for a down payment on a house or retiring early. You can track your progress towards these goals and adjust your spending accordingly.

Data Visualization

The tracker includes data visualization features, such as charts and graphs, that help you visualize your financial data. This makes it easier to identify trends and patterns in your spending and saving habits.

Example: A bar chart can show you how your spending in different categories has changed over time, helping you identify areas where you may need to cut back.

Customizing the Tracker

The Google Sheets Personal Finance Tracker 2024 is a versatile tool that can be tailored to meet your specific financial needs. Here’s how you can customize it:

Adding or Removing Categories

- To add a category, right-click on any category row and select “Insert row above” or “Insert row below.” Enter the new category name in the “Category” column.

- To remove a category, right-click on the category row and select “Delete row.” Note that deleting a category will also remove all associated transactions.

Adjusting Formulas and Calculations

The tracker uses formulas to calculate balances, totals, and other financial metrics. You can adjust these formulas to suit your needs:

- To adjust a formula, click on the cell containing the formula and edit it directly. Ensure that you understand the formula and make changes carefully to avoid errors.

- You can also create custom formulas using Google Sheets functions. For example, you could create a formula to calculate the average spending in a specific category.

Creating Custom Reports, Google Sheets Personal Finance Tracker 2024

The tracker provides pre-built reports, but you can also create custom reports to visualize your financial data in different ways:

- Go to the “Reports” tab and click on “Create new report.”

- Select the data you want to include in the report and customize the report settings (e.g., chart type, filters).

- Once you’re satisfied with the report, click “Save” to create it.

Data Analysis and Reporting: Google Sheets Personal Finance Tracker 2024

Data analysis is crucial for effective personal finance management. It allows you to understand your financial habits, identify areas for improvement, and make informed decisions about your money.

Google Sheets offers a range of tools for analyzing your financial data. You can use formulas to calculate key metrics like your total income, expenses, and net worth. You can also create charts and graphs to visualize your data and spot trends.

Generating Reports and Insights

Once you have analyzed your data, you can generate reports and insights to help you make informed financial decisions. For example, you can create a budget report to track your income and expenses, or a net worth statement to see how your wealth is growing over time.

Google Sheets also allows you to share your reports with others, such as your financial advisor or accountant. This can be helpful for getting feedback on your financial situation and making sure you are on track to meet your financial goals.

Tip: Use pivot tables to summarize and analyze your data. Pivot tables allow you to quickly and easily create reports that show your data in different ways.

Additional Tips and Best Practices

Maximizing the potential of Google Sheets as a personal finance tracker requires strategic planning and consistent effort. Here are some additional tips and best practices to enhance your experience:

Organization and Efficiency

- Create multiple sheets:Organize your finances by separating different aspects into individual sheets, such as budgeting, expenses, investments, and savings.

- Use color coding:Assign specific colors to different categories or accounts to improve visual clarity and quick identification.

- Automate tasks:Utilize formulas and scripts to automate calculations, saving time and reducing errors.

Motivation and Accountability

- Set realistic goals:Establish achievable financial targets to stay motivated and avoid discouragement.

- Track your progress regularly:Monitor your financial situation frequently to identify areas for improvement and celebrate successes.

- Share your tracker:Consider sharing your tracker with a trusted individual for accountability and support.

Successful Use Cases

- Budgeting:Track income, expenses, and savings to create a comprehensive budget that aligns with financial goals.

- Debt management:Monitor debt balances, interest rates, and repayment schedules to optimize debt repayment strategies.

- Investment tracking:Monitor investment portfolios, track performance, and make informed investment decisions.

Outcome Summary

Unlock the full potential of your finances with the Google Sheets Personal Finance Tracker 2024. By leveraging its advanced features, you’ll gain invaluable insights into your spending habits, identify areas for improvement, and make informed financial decisions that lead to financial freedom.

FAQ Overview

Can I use the Google Sheets Personal Finance Tracker on my phone?

Yes, you can access and edit your Google Sheets Personal Finance Tracker from any device with an internet connection, including your phone.

Is the Google Sheets Personal Finance Tracker free to use?

Yes, the Google Sheets Personal Finance Tracker is completely free to use. You only need a Google account to get started.

Can I share my Google Sheets Personal Finance Tracker with others?

Yes, you can share your Google Sheets Personal Finance Tracker with others by granting them edit or view-only access.