Welcome to the world of Personal Finance Budget 2024, where we embark on a journey to unravel the secrets of financial planning and empower you to take control of your monetary future. Whether you’re a seasoned investor or just starting your financial literacy journey, this guide will provide you with the tools and strategies to navigate the ever-changing landscape of personal finance.

In this comprehensive guide, we’ll delve into the intricacies of budgeting, explore income and expense analysis, and discover the latest budgeting tools and technologies. We’ll uncover the secrets of saving and investment, tackle debt management and reduction, and provide tailored budgeting strategies for different life events and income levels.

Along the way, we’ll empower you to create a family budget that meets everyone’s needs and involve your children in financial decision-making.

Budget Planning for 2024

Kickstarting the new year with a solid financial plan is crucial for achieving your financial goals. A well-structured budget will help you track your income and expenses, make informed decisions about your spending, and stay on top of your financial health.

Here’s a comprehensive guide to help you create a realistic and achievable budget for 2024:

Setting Financial Goals

The foundation of any budget lies in defining your financial goals. These could include saving for a down payment on a house, paying off debt, or investing for the future. Having clear goals will give your budget a purpose and help you stay motivated throughout the year.

Creating a Realistic Budget

Start by gathering your financial information, including your income, expenses, and assets. Categorize your expenses into fixed (e.g., rent, car payment) and variable (e.g., groceries, entertainment). Allocate your income to each category, ensuring that your expenses do not exceed your income.

Tracking Expenses and Income

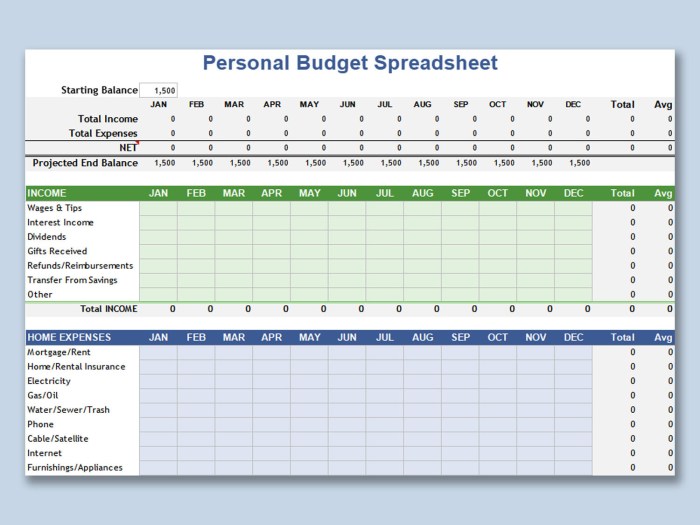

Regularly monitoring your expenses and income is essential for staying on track. Use a budgeting app, spreadsheet, or notebook to record every transaction. This will help you identify areas where you can save money or adjust your spending habits.

Income and Expense Analysis

Effective financial planning hinges on a comprehensive understanding of your income streams and expenses. This analysis empowers you to optimize earnings, prioritize spending, and identify potential savings areas, ultimately fostering financial stability and progress towards your goals.

Income Streams and Strategies for Increasing Earnings

- Primary Income:Wages, salaries, commissions, or business revenue.

- Secondary Income:Part-time jobs, freelancing, investments, or rental properties.

- Passive Income:Earnings generated with minimal ongoing effort, such as dividends, interest, or royalties.

To boost income, consider:

- Negotiating salary increases or bonuses.

- Pursuing additional certifications or training to enhance your skills and value.

- Exploring side hustles or entrepreneurial ventures.

- Investing in income-generating assets.

Categorizing and Prioritizing Expenses

Categorizing expenses helps you track and manage your spending. Common categories include:

- Fixed Expenses:Consistent and essential costs like rent, mortgage, car payments, and insurance.

- Variable Expenses:Fluctuating costs like groceries, utilities, entertainment, and dining out.

- Discretionary Expenses:Non-essential expenses that can be adjusted, such as travel, shopping, or hobbies.

Prioritize expenses based on their importance and impact on your financial goals. Essential expenses should be prioritized over discretionary ones.

Identifying Areas for Potential Savings

Regularly review your expenses to identify potential savings areas. Consider:

- Negotiating lower rates:Contact service providers (e.g., internet, phone, insurance) to negotiate better deals.

- Reducing unnecessary expenses:Eliminate non-essential subscriptions, memberships, or services.

- Optimizing purchases:Research and compare prices, use coupons, and take advantage of sales.

- Consolidating expenses:Combine similar expenses (e.g., multiple insurance policies) to reduce premiums.

- Adopting cost-effective habits:Consider energy-efficient appliances, carpooling, or using public transportation.

Budgeting Tools and Technology

In the digital age, a wide range of budgeting apps and software can streamline your financial management. These tools offer various features to help you track expenses, create budgets, and automate financial tasks.

Budgeting Apps, Personal Finance Budget 2024

- Mint:Comprehensive app that connects to your bank accounts and categorizes transactions automatically.

- YNAB (You Need a Budget):Focuses on zero-based budgeting, where every dollar is assigned a purpose.

- EveryDollar:Simple app based on Dave Ramsey’s budgeting principles.

Budgeting Software

- Quicken:Desktop software with robust features for budgeting, tracking investments, and tax preparation.

- Moneydance:Open-source software that allows for extensive customization.

- GnuCash:Free and open-source software with advanced features for small businesses.

Benefits of Budgeting Tools

- Convenience:Track expenses and manage budgets on the go.

- Automation:Automate tasks like bill payments and expense tracking.

- Data analysis:Generate reports and insights to identify spending patterns and areas for improvement.

Limitations of Budgeting Tools

- Accuracy:Transactions may not be categorized correctly, requiring manual adjustments.

- Cost:Some apps and software require a subscription fee.

- Security:Ensure the tool you choose has strong security measures to protect your financial data.

Saving and Investment Strategies: Personal Finance Budget 2024

Securing your financial future requires prudent saving and investment strategies. An emergency fund serves as a safety net, while investing helps grow your wealth over time. Diversifying your investments is crucial to mitigate risk and enhance returns.

Setting Up an Emergency Fund

An emergency fund provides a financial cushion for unexpected expenses, such as medical emergencies or job loss. Aim to save three to six months’ worth of living expenses in a high-yield savings account or money market account.

Investment Options

- Stocks:Represent ownership in companies and offer the potential for high returns but also carry higher risk.

- Bonds:Loans made to companies or governments, offering lower returns but typically less risk than stocks.

- Mutual Funds:Diversified baskets of stocks or bonds managed by professionals, providing exposure to a range of assets.

- Exchange-Traded Funds (ETFs):Similar to mutual funds but traded on stock exchanges, offering lower fees and more flexibility.

- Real Estate:Investing in property can generate rental income and potential appreciation in value, but it also involves higher upfront costs and ongoing maintenance.

Importance of Diversifying Investments

Diversifying investments reduces risk by spreading your assets across different types of investments. This ensures that the performance of one asset class does not significantly impact your overall portfolio. For example, combining stocks with bonds or real estate can help balance potential gains and losses.

Debt Management and Reduction

Managing debt effectively is crucial for financial stability and long-term financial success. This section provides strategies for paying off debt faster, the benefits of debt consolidation and refinancing, and the impact of high-interest debt on financial stability.

Strategies for Paying Off Debt Faster

- Create a budget:Track your income and expenses to identify areas where you can cut back and allocate more funds towards debt repayment.

- Prioritize high-interest debt:Focus on paying off debts with the highest interest rates first to minimize interest charges.

- Consider debt consolidation:Combine multiple debts into a single loan with a lower interest rate, potentially saving money on interest and simplifying repayment.

- Explore refinancing:If you have good credit, you may be able to refinance your existing debt at a lower interest rate, reducing your monthly payments.

- Negotiate with creditors:In some cases, you may be able to negotiate with creditors to reduce interest rates or payment amounts.

Benefits of Debt Consolidation and Refinancing

- Lower interest rates:Debt consolidation and refinancing can potentially lower your interest rates, saving you money on interest charges.

- Simplified repayment:Combining multiple debts into a single loan simplifies repayment and helps you stay organized.

- Improved credit score:Paying off debt on time and reducing your debt-to-income ratio can improve your credit score.

Impact of High-Interest Debt on Financial Stability

- Increased interest charges:High-interest debt can lead to significant interest charges, making it more difficult to pay off the debt and potentially leading to a debt spiral.

- Reduced cash flow:High debt payments can consume a large portion of your income, reducing your available cash flow for other expenses and savings.

- Damage to credit score:Missed or late payments on high-interest debt can negatively impact your credit score, making it more difficult to obtain future credit at favorable terms.

Budgeting for Specific Life Events

Life is full of surprises, and it’s essential to be financially prepared for the unexpected. Budgeting for specific life events can help you stay on track and avoid financial stress.

Saving for Major Expenses

Major life events, such as weddings, home purchases, or starting a family, can put a significant strain on your finances. Start saving early and set realistic goals to avoid going into debt.

- Weddings:Estimate costs for venue, catering, dress, and entertainment. Consider setting up a separate savings account.

- Home Purchases:Factor in down payment, closing costs, and ongoing expenses like mortgage, property taxes, and insurance.

- Starting a Family:Prepare for medical expenses, childcare, and additional household costs.

Planning for Retirement

Retirement may seem far away, but it’s never too early to start saving. Take advantage of employer-sponsored retirement plans and explore other investment options.

- 401(k) and IRAs:Offer tax-advantaged savings for retirement.

- Annuities:Provide a guaranteed income stream in retirement.

- Real Estate:Can be a long-term investment with potential for appreciation and rental income.

Handling Financial Emergencies

Financial emergencies can strike at any time. Having an emergency fund can help you cover unexpected expenses without resorting to debt.

- Aim for 3-6 months’ worth of living expenses:This provides a safety net for job loss, medical bills, or other unforeseen circumstances.

- Keep it in a high-yield savings account:For easy access when you need it.

- Consider disability and life insurance:To protect your income and family in case of unforeseen events.

Budgeting for Different Income Levels

Creating a budget is essential for managing finances effectively, regardless of income level. This section will provide budgeting tips tailored to individuals with varying income levels, addressing the unique challenges and opportunities they may face.

Budgeting on a Low Income

Budgeting on a low income requires careful planning and discipline. Consider the following strategies:

- Track expenses meticulously:Keep a detailed record of all expenses, no matter how small, to identify areas where spending can be reduced.

- Prioritize essential expenses:Focus on allocating funds towards essential expenses such as housing, food, and transportation before allocating to non-essential items.

- Seek assistance programs:Explore government or non-profit programs that provide financial assistance, such as food stamps or housing assistance.

Budgeting on a High Income

While budgeting on a high income may seem less challenging, it’s equally important to manage finances wisely. Consider these tips:

- Avoid lifestyle inflation:Resist the temptation to increase spending as income rises. Instead, focus on saving and investing for the future.

- Consider tax implications:High earners may face higher tax rates, so factor in tax deductions and investments to minimize tax liability.

- Invest strategically:Diversify investments across various asset classes to mitigate risk and maximize returns.

Adjusting Budgeting Strategies with Changes in Income

Income levels can fluctuate over time. When income changes, it’s crucial to adjust budgeting strategies accordingly:

- Income increase:If income increases, prioritize increasing savings and investments while considering a modest increase in non-essential spending.

- Income decrease:If income decreases, review expenses and identify areas where spending can be reduced without compromising essential needs.

Budgeting for Families and Households

Creating a family budget is crucial for ensuring financial stability and meeting the needs of every family member. It involves planning and allocating income to cover expenses, savings, and investments. By involving children in financial decision-making and implementing effective strategies, families can manage household expenses and shared financial responsibilities effectively.

Tips for Creating a Family Budget

- Involve family members:Encourage open communication and input from all family members to ensure everyone’s needs are considered.

- Set financial goals:Establish specific, measurable, achievable, relevant, and time-bound financial goals to guide budgeting decisions.

- Track expenses:Monitor spending habits using tools like budgeting apps, spreadsheets, or simply writing down expenses to identify areas where adjustments can be made.

- Categorize expenses:Group expenses into categories such as housing, transportation, food, and entertainment to analyze spending patterns.

- Negotiate and compromise:Be willing to negotiate and compromise on expenses to reach a budget that works for everyone.

- Review and adjust:Regularly review the budget and make adjustments as needed to ensure it remains effective and aligned with changing circumstances.

Involving Children in Financial Decision-Making

Involving children in financial decision-making teaches them valuable lessons about money management and responsibility. Age-appropriate tasks can include:

- Setting up a savings account:Open a savings account for children and encourage them to contribute and track their savings.

- Managing an allowance:Provide children with an allowance and guide them in making spending and saving decisions.

- Discussing family finances:Share information about family income and expenses with children in a simplified and age-appropriate manner.

Managing Household Expenses and Shared Financial Responsibilities

Effective management of household expenses and shared financial responsibilities is essential for family financial well-being. Strategies include:

- Establish a joint account:Create a joint bank account for shared expenses and responsibilities.

- Assign specific tasks:Divide household chores and financial tasks among family members based on age and abilities.

- Use technology:Utilize budgeting apps, online banking, and other tools to streamline financial management.

- Communicate openly:Maintain open and regular communication about financial matters to avoid misunderstandings.

Last Point

As we conclude our exploration of Personal Finance Budget 2024, remember that financial planning is an ongoing journey, not a destination. Embrace the principles Artikeld in this guide, adapt them to your unique circumstances, and stay committed to your financial goals.

By taking control of your finances, you unlock the power to achieve your dreams, secure your future, and live a life of financial freedom.

User Queries

What is the most important aspect of personal finance budgeting?

Setting realistic and achievable financial goals is the foundation of successful personal finance budgeting.

How can I track my expenses and income effectively?

Utilizing budgeting apps, spreadsheets, or simply a notebook and pen can help you stay organized and monitor your financial transactions.

What are some strategies for reducing debt?

Creating a debt repayment plan, consolidating high-interest debts, and exploring refinancing options can help you pay off debt faster.

How can I involve my family in financial decision-making?

Open and transparent communication, age-appropriate financial education, and shared budgeting responsibilities can foster family involvement in financial planning.